UX at mortgages & Research Lead of Personal Area

Banc Sabadell offers an online simulator to find out what monthly loan will be, as part of a 100% digital hiring process to complete information, upload documents and finally sign a mortgage

As the UX of the squad, my mission was to analyze and define solutions by:

- Discovery of mortgage process and user needs

- Researching throw moderated and unmoderated testing

- Analyzing quantitative data: entry points, bouncing and conversion

- Validating real impact of new solutions after iteration

I had an additional role as Research Lead advising other squads on research and testing issues, defining good practices and promoting workshops

resume

Research that drives into a big impact on leads throw a simple iteration

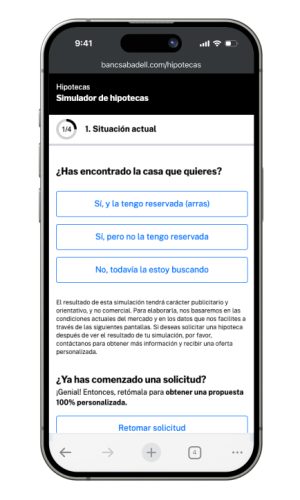

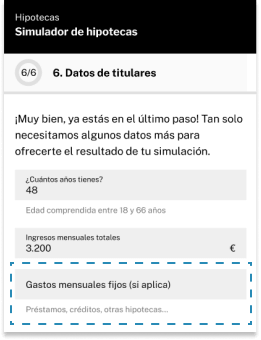

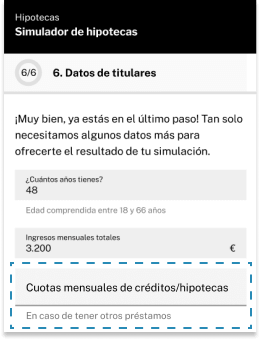

One of the simulator steps includes effort rules: income minus monthly expenses allocated to other loans and mortgages.

The result impacts lowering the payments that can be offered to the user, and if they do not reach a minimum percentage, don’t receive an offer and an error message is shown.

problem & validation

After an initial heuristic analysis of the flow, I detected:

Text regarding «monthly expenses» could be misunderstood by users, negatively impacting the effort rules and the offer shown

This hypothesis was validated by:

- Qualitative testing with User Zoom

Insights and verbatims confirm that users understood this field broadly, entering incorrect amounts and getting unreal offers. - Google Analytics

Error Page for not reaching the minimum requirements is shown to users repeatedly. - Analysis of the offered mortgage database

Discrepancies were detected regarding the logical rules of the mortgage products.

iteration & solution validation

After detecting and validating the problem, the following steps were taken:

- Benchmarking on the “expenses” field, where it is verified that the treatment differs in other banks.

- Proposal for iteration of copy with higher cognitive load given the sensitivity of the data.

Validation of the proposal through unmoderated tests with UserZoom.

impact on simulator

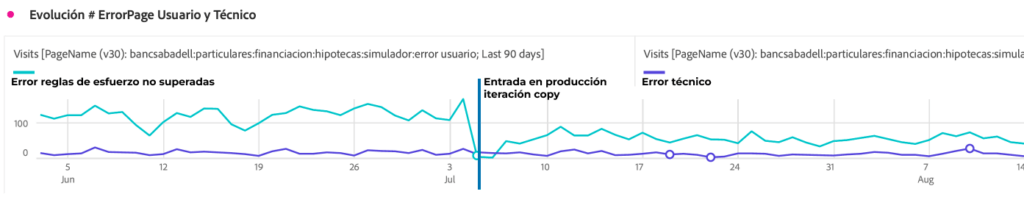

The production rollout shows an immediate and consistent impact on:

- + 1.6% leads generated in the simulator

- – 31% amounts entered as expenses

- – 45% error screen impressions due to effort rules

key takeaways

Main lessons I have learned working there where:

- To leading and defining research methodologies and get that all squads were committed to apply on their discovery processes

- How important is data to convince stakeholders on big companies

- Technical legacy can be a huge stopper to get things done and how to manage with it

let’s connect

Please don’t hesitate to reach out if you would like to have some more information. I will do my best to respond to you in a timely manner. Thanks!